| KPI | Definition | Commitment | Performance | Historic Performance |

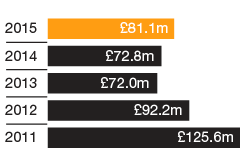

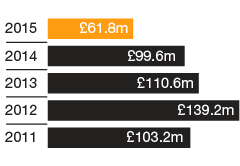

| Underlying Profit before tax | Measures the normal underlying performance of the business after removing non-recurring items | The Board considers that this measurement of profitability provides stakeholders with information on trends and performance. | Underlying profit grew by 11.4% year-on-year with the strong sales performance reflected in improved profitability. |  |

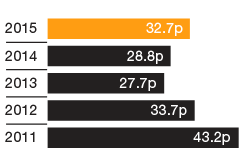

| Underlying Earnings per Share | Underlying profits as defined above divided by the number of shares in issue | EPS is a measure of our investment thesis and as such we aim to manage revenues and margins and invest in long term growth. | As a result of the increase in underlying profit before tax EPS rose by 13.8% |  |

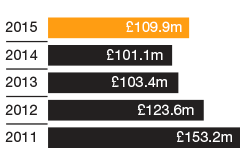

| EBITDA | Earnings before Interest, Tax, Depreciation and Amortisation | The Board considers that this measurement of profitability is a viable alternative to underlying profit and uses this measure to incentivise management. | EBITDA improved by 8.7%, reflecting the improved profitability flowing through from the strong sales growth. |  |

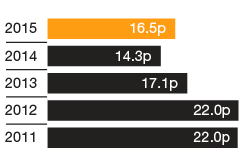

| Dividend per Ordinary Share | Cash returned to shareholders as a return on their investment in the Company | To maintain this policy whilst retaining the flexibility to invest when opportunities are identified. | The Board has recommended a final dividend of 11.0 pence per share (FY14: 9.1 pence) taking the full year dividend to 16.5 pence, an increase of 15.4%. The Board will continue to maintain a c.2× dividend cover over the medium term. |  |

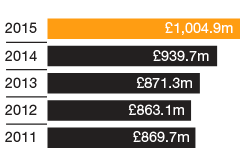

| Total Revenues | Total sales revenues from all business activities | The Group is committed to growing sales in all of its core trading activities. | Group revenues were up 6.9% and exceeded our £1bn target a year ahead of plan. |  |

| Net Debt | Bank debt plus finance leases, less cash and cash equivalents both in-hand and at bank | The Group remains strongly cash generative and continues to invest in the business. The Board is committed to maintaining an efficient balance sheet, returning any surplus capital not required to fund growth to shareholders. | The Group has continued its strong track record of operating cash generation. |  |

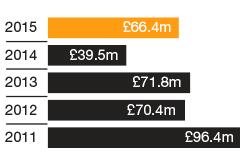

| Free Cash Flow | Cash generated from activities, less taxation, capital expenditure and net finance costs | The Group has a track record of robust cash generation which the Board intends to continue. | The Free Cash Flow of £66.4m is after the Boardman acquisition and increased capital expenditure as we progress through the Getting Into Gear plan. |  |